Printable Money is Good for Everyone that Controls the Money Printer.

Bitcoin is SCARCE. FIAT(the USD) is not.

Asset (House) prices go down in terms of Bitcoin over time.

-The above graphs should be self explanatory. Supply and demand create true value.

-The USD is being printed to infinity.

Bitcoin is the first form of true scarcity in human history.

-The supply schedule is fixed in the code and cannot be changed. 21M total. Ever.

-Demand for Bitcoin is increasing exponentially while new supply is going to zero.

Cost of a house in 2028?

--------------------------------------------------------

---------- in USD? $550,000? ------------

---------- in Bitcoin? 1? ------------

--------------------------------------------------------

As of Jan 2026 ------ 1 house = 4.8 BTC

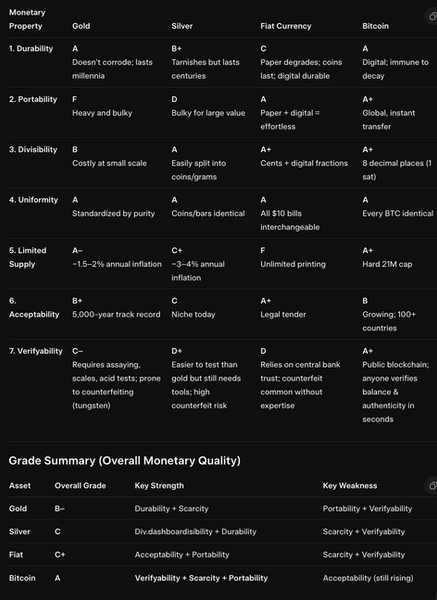

The Properties of Money

The Above Data in Chart Form

Time is Money

--------------------------------------------------------

Time and bitcoin are finite.

FIAT is infinite and is not real money.

10 years ago, it took a week to save 1 Bitcoin.

Now it takes 1.5 years.

This chart must be understood before you can understand Bitcoin.

Where to start learning?

-

Start with these articles.

2. Or these videos.

3. Or either of these books.

Common Misconceptions

Bitcoin isn’t backed by anything

-Bitcoin is backed by it's superior monetary properties, the most important being finite scarcity.(see supply chart above)

-The finite scarcity is enforced through decentralized consensus.

-Bitcoin is backed by the computing power securing the network(the most secure network in the world).

-Bitcoin is backed by the number of users of the network.

Both of these are increasing exponentially.

-See graphs of the hash rate (computing power), and number of users(nonzero addresses) – charts below

Bitcoin is not Backed by Nothing - Parker Lewis article (Sep 2019)

Electrical power securing the network

Network Size (orange line)

What is an EH/s?

Bitcoin and Crypto are the same thing

-Bitcoin is fully decentralized – the network consists of miners in 175+ countries

-There is no company, no board, no CEO, no employees – it is an open-source protocol

-All other cryptos are centralized to different degrees

- Other coins can be shut down by the government - Bitcoin cannot.

-Bitcoin is a revolutionary technology. Other cryptos are just companies. 90% are complete scams.

-Investing in other coins is much more akin to gambling. Do so at your own risk.

-The two articles below explain this concept in much more detail.

Bitcoin, not Blockchain - Parker Lewis article (Sep 2019)

Dear Crypto & Fiat Bros - Dergigi article

Bitcoin will replace daily transactions

-The Layer 1 Bitcoin protocol is built to be decentralized and secure at the expense of speed.

-It is competing with final transaction settlements – bank transfers of cash between banks(days to weeks)

-Layer 2, 3, and 4 applications(Lightning/Liquid/others) will compete with daily transactions

Bitcoin is a store of value that is gradually replacing stocks/bonds/treasuries and real estate.

Real estate will return to being valued as a property, not as a store of value.

Bitcoin is not too Slow - Parker Lewis article (Aug 2019)

Bitcoin is only used by criminals

-The same thing was said of the internet in the early 90s

-99% of crime is accomplished with FIAT money

-Bitcoin is on a public ledger – all transactions are public and can be tracked

-The addresses can be anonymous, but the fact that every transaction is public is a red flag for criminals

Bitcoin is not for Criminals - Parker Lewis article (Nov 2019)

Bitcoin is just digital gold

-Before Bitcoin, gold was the best money the world had ever seen

-But it had flaws, mainly portability, verifiability, and divisibility

-Governments were able to capitalize on these flaws and take it from people

-The paper gold(ETFs, receipts) today is estimated at 250x the true amount of gold in existence

-With true supply and demand, the FIAT value of gold today would be greater than 250x the current price

Bitcoin Obsoletes all Other Money - Parker Lewis Article (Jan 2020)

Bitcoin can be understood in a few hours

-Understanding how and why Bitcoin is a revolutionary technology takes time and effort.

-Everyone will learn eventually, but those who learn sooner will benefit to a greater degree.

-you have to learn how the current monetary system works and how it came to be.

-you have to understand the history of central banks, FIAT, fractional reserve banking, and money printing

-you have to learn Austrian Economics – which is based on human decisions

-you have to learn the properties of money and how the Bitcoin protocol works

Satoshi's original announcement of Bitcoin (February 11, 2009)

Do Bitcoin or FIAT require trust?